Yesterday I received my wife’s New York & Co credit card statement and I noticed a charge that caught my attention. It was for $1 and had “Processing Fee” for the Transaction Description. I was a bit confused by the charge so I started reading the bill a bit more carefully to find out what it was for. What I learned was a bit shocking and, in my opinion, wrong.

A bit further down the statement there was more of an explanation: “A one-dollar processing fee will be charged on every paper statement. We will waive this fee if you choose to receive paperless statements” and then there was a URL to tell you how to sign up for paperless statements. Don’t get me wrong, I’m all for saving the environment and against cutting down trees. Every week, my family and I do huge amounts of recycling and my kids are taught what the different recycling symbols mean on plastic containers and such.

What bothers me about this charge is the fact that it is actually a fee. I know plenty of other companies like my bank or my cell phone provider that offer the same type of paperless statement service. However they do it differently, they offer more of a positive reward than a negative one to convince you to switch to paperless statements. Sometimes these rewards come in the form of a slight discount or a one-time credit of some sort, and most often talk about some additional benefits you would receive if you switched to paperless statements, like the ability to see more statements, or having the convenience of not having to store physical statements. But never is there a mention of an additional charge to “have the luxury of paperless statements.” Some companies even say that they will donate to a Nature Conservation organization if a customer switches to paperless.

In my opinion, charging a customer to force them down a path that is, in the end, more profitable for you, is a form of extortion. Basically, “Bruno the Bruiser” at this credit card company and other companies that employ a similar strategy are saying, “you will now sign up for paperless statements otherwise every month I will come by and collect and keep charging you until you do switch!” Sure, it is only $12 a year but there are some other things at play here. For starters, what if you don’t have access to the internet? Do you get to charge them for your internet access so that you can get your $1/bill waived? Seems like “lack of internet” discrimination to me!

But let’s also think about this from a monetary perspective. It costs to have statements printed and mailed out every month. I understand this. I’m not sure, however, that the costs add up to $1 per statement. Ink and paper are not that expensive. The bills are also bulk mailed so do not get hit with a first class postage charge (probably not bulk either – so someone should correct me about that). Regardless, even after all of that, they are coming ahead in the end. It does get a bit more tricky if the customer is mailing back a check. There is the manual (?) processing involved there so I could understand that added cost. Here is actually an interesting read about the whole “save a tree by going paperless” initiative – let’s not forget about the Paper Industry, going paperless hurts that economy.

However, once you switch over to paperless statements, the credit card company (or any company that provides billing statements) instantly makes more money off of your transaction. For starters, they don’t have to print the bill, nor have to pay for postage. Also, they are not charged with a fee for processing your checks. I typically pay my bills using an online bill pay service (of which I’m charged a fee), but I understand it is a sort of “convenience fee”. But I’m the one who gets the convenience there. For credit card companies, they receive a much larger convenience for doing everything digitally.

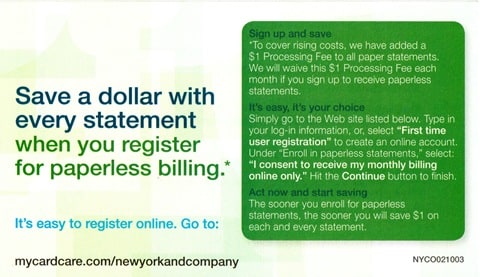

Here is the insert that came with the bill (oh, and a side thought, how much did it cost to print this glossy insert and what was the impact to the environment?):

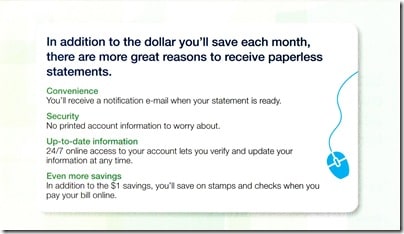

While I can appreciate companies moving towards a paperless environment and billing process (it simply makes cents, sorry, sense), I think that consumers should be given the option to do this and not be forced to pay a fee should they choose to NOT go paperless. Companies should really create an incentive for consumers to switch on their own by offering other benefits. In this example, NY&Co does does do this by stating the following benefits:

- Security: Avoid printed account information to safeguard from identity theft. Our site uses leading security software and standards to ensure that your information is protected.

- Savings: We assess a $1 Processing Fee on each paper statement. We will waive this $1 fee on each and every statement if you register to receive your monthly billing statements online only. You will also save the cost of stamps if you pay your bill online.

- Convenience: No paper statement to misplace; your monthly statement is readily available with all other account information, 24 hours a day, 7 days a week.

- Simplicity: It’s easy to enroll, easy to access, and easy to make payments.

On that site, they state time and time again that they are “in the process of switching to PDF statements.” So, is this $1 fee helping to pay for a transition that most other companies that bill have been doing for a while? It does make one think that this fee is simply a way for them to cover their “rising costs” as mentioned in the billing insert. But how am I saving money on something that I wasn’t charged for before? What really bothers me about the billing insert is the statement “Save a dollar with every statement”. This dollar charge didn’t exist until someone decided that customers should be charged it. Uh WHAT?!

My advice to companies looking to transition customers over to paperless billing statements is this. Incentivize them! Tell them the benefits (some of which are listed above). Offer them a one time credit to switch. Yes the company runs the risk of having the customer get the credit when they switch to paperless and then if the customer switches back, the company loses out; but this might be a worthwhile risk. You could also say that you get a $1 credit for every month you go paperless, or in the case of NY&Co, a clothing retailer, or other similar companies give them regular coupons to go spend money in the store if they switch over. It could be a coupon that is emailed or only downloadable from the statement site. Make it seem “exclusive.” THAT will get customers to switch, not a fee if they don’t!

As it stands now, seeing the fee makes me more upset than anything, even if it is only $1. I just disagree with the statement it makes. Of course, this is just my opinion and you are welcome to yours. I don’t have insight into how much it costs a company to produce paper statements nor how much they save by switching to paperless. If anyone knows, please leave a comment.

Also, I would love to know your thoughts on this practice. Is it a good move? Is there a better way to do it? If you were charged this, how would you feel about the company charging you? What do you think the “best practice” is for paperless statements and encouraging customers to transition over. Let me know!

HTD says: Rant aside, there are always multiple ways to approach the same issue. Choose the wrong one, and you will piss off your customers. Choose the proper one, they may like you more (or worst case, just simply not notice).

1 comment

Sam

You could have done some research before complaining. Pick up any bill and look in the corner. Presort First Class. Cheapest rate $.33. Printing, sorting, sending it to the post office. Cost of the envelope. Close to, if not more than $1. The US is one of the few countries where paper bills are free. Charging for paper bills is common, if not the case, in Europe and Asia. Honestly, nobody's going to switch to e bill if all you get is a lousy coupon and meanwhile they'll cut down more forests for paper.